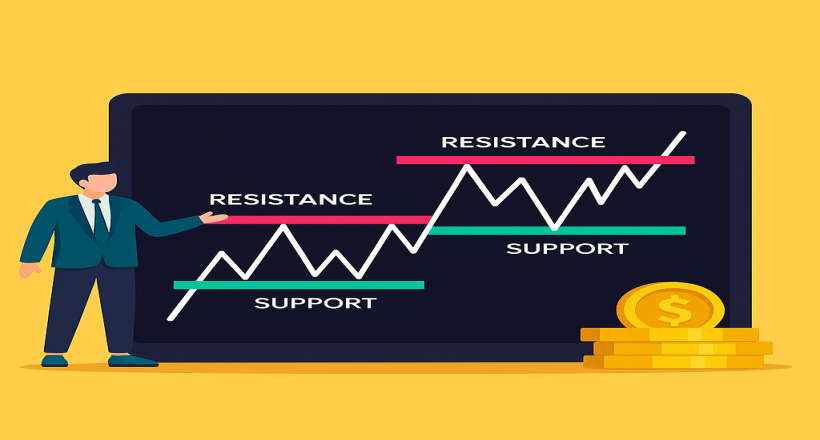

In the world of technical analysis, accurately identifying support and resistance levels is one of the core skills for trading success. Traders and investors, especially in the cryptocurrency market, rely on these concepts to predict price behavior and determine optimal entry and exit points.

In this comprehensive article, we’ll explore the definitions of support and resistance, their importance, how to identify them, and how to apply them effectively in crypto trading.

What Is a Support Level?

A support level is a price zone where buying interest is strong enough to prevent the asset’s price from falling further. At this level, many buyers enter the market while sellers show less willingness to sell.

Simply put, when the price of a cryptocurrency approaches a support level, there's a high probability it will either stop falling or even reverse upward.

Key characteristics of support levels:

What Is a Resistance Level?

A resistance level works in the opposite way. It is a price zone where selling interest is high enough to prevent further price increases. As the price nears this level, the upward movement often slows or reverses.

Key characteristics of resistance levels:

Why Are Support and Resistance Levels Important in Technical Analysis?

Support and resistance levels are critical to market structure. They help traders for several reasons:

How to Identify Support and Resistance Levels

Properly identifying support and resistance requires analyzing price charts. Several methods can help:

1. Price Reversal Zones

Look for areas where price has repeatedly reversed in the past—these are strong support or resistance zones.

2. Trendlines

Drawing upward or downward trendlines can help locate support and resistance areas.

3. Technical Indicators

Tools like Moving Averages or Fibonacci Retracement can act as dynamic support/resistance levels.

4. Trading Volume

High volume near certain price levels often indicates their importance as support or resistance.

The Role of Support and Resistance in Crypto Trading

In the volatile and fast-moving crypto market, using support and resistance is vital for success. Some practical applications include:

Key Tips for Using Support and Resistance

Conclusion

Support and resistance levels are among the most fundamental and widely used tools in technical analysis. In crypto trading, where market sentiment shifts rapidly, mastering these concepts can give traders a crucial edge.

However, it's important to remember that no level is permanent. Markets evolve, and so do these zones. By combining sound risk management with ongoing analysis, traders can make smarter and more strategic decisions.